Blockchain Integration for Small Business Accounting

Blockchain has emerged as a transformative force, offering unprecedented opportunities for small businesses to streamline their accounting processes. Traditionally associated with cryptocurrencies like Bitcoin, blockchain technology has transcended its initial applications to reshape the way businesses manage their financial data. In this era of digital innovation, the integration of blockchain into accounting systems is proving to be a game-changer for small enterprises.

Blockchain Basics

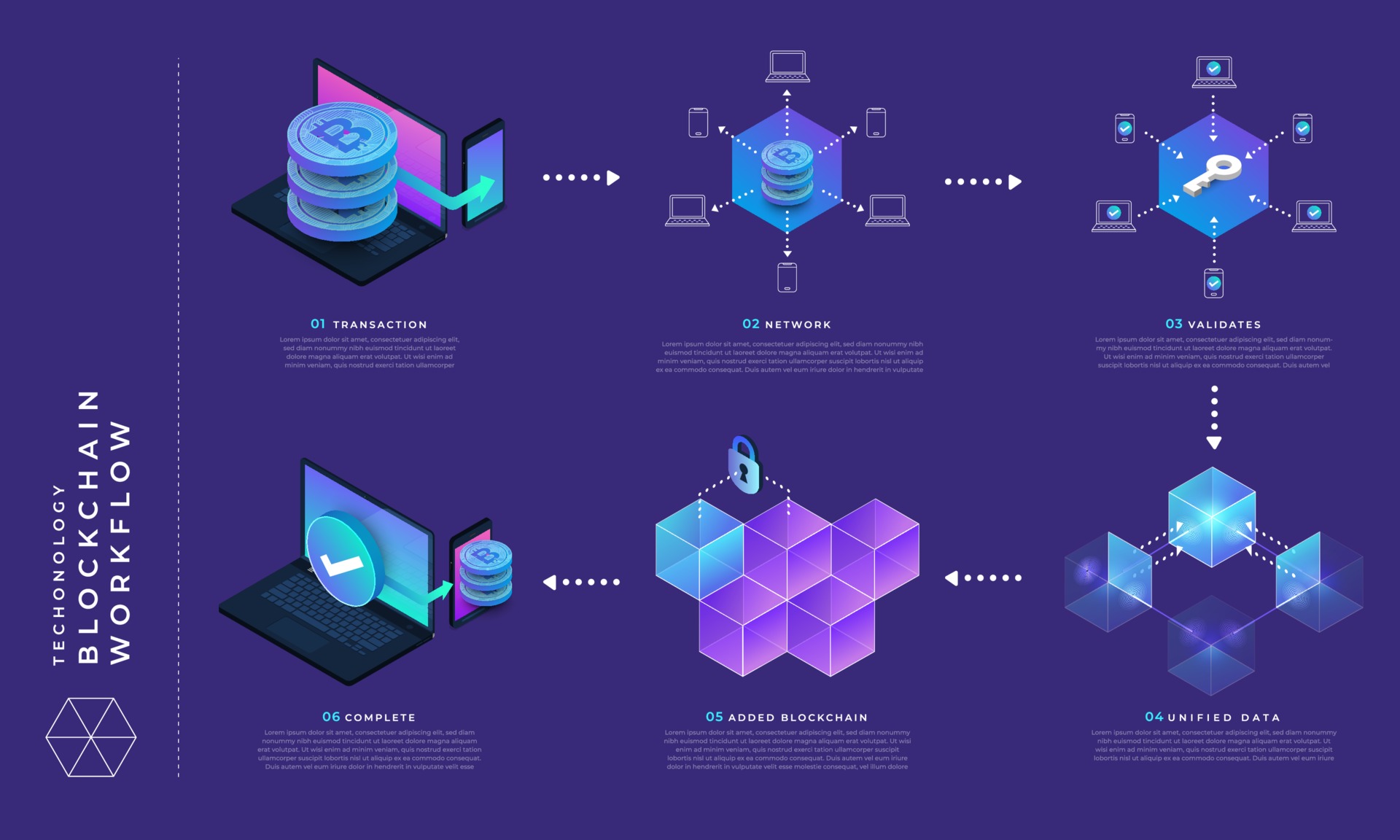

Blockchain, at its core, is a decentralized, distributed ledger that records transactions across a network of computers. Each transaction, or "block," is linked to the previous one, forming a chain of blocks. The decentralized nature of blockchain ensures transparency, security, and immutability of data, making it an ideal candidate for revolutionizing accounting practices.

Enhanced Security and Transparency

One of the key advantages of incorporating blockchain into small business accounting is heightened security. Traditional accounting systems often face the risk of data breaches and fraud. With blockchain, each transaction is cryptographically secured and linked to the preceding one, creating a tamper-resistant chain. This level of transparency not only safeguards financial data but also builds trust among stakeholders.

Streamlined Auditing Processes

The immutability of blockchain records simplifies the auditing process for small businesses. Auditors can trace transactions back to their origin and verify the accuracy of financial statements with greater efficiency. This not only reduces the time and resources required for audits but also ensures a higher level of accuracy and reliability in financial reporting.

Smart Contracts for Efficiency

Blockchain introduces the concept of smart contracts, self-executing contracts with the terms of the agreement directly written into code. Small businesses can utilize smart contracts to automate various financial processes, such as invoicing and payment verification. This automation not only reduces the risk of errors but also enhances operational efficiency, allowing businesses to focus on their core activities.

Cost Savings and Accessibility

For small businesses with limited resources, cost-effectiveness is paramount. Blockchain eliminates the need for intermediaries, such as banks or third-party payment processors, reducing transaction costs. Additionally, the decentralized nature of blockchain makes financial data accessible in real-time from anywhere, empowering small business owners to make informed decisions promptly.

Regulatory Compliance

Adopting blockchain technology can assist small businesses in meeting regulatory compliance standards. The transparent and traceable nature of blockchain transactions simplifies the reporting process, helping businesses adhere to tax regulations and other legal requirements.

Looking Ahead

As blockchain technology continues to mature, its integration into small business accounting systems holds immense potential. While challenges such as scalability and regulatory uncertainty exist, the benefits of enhanced security, transparency, cost savings, and streamlined processes make blockchain an attractive option for small enterprises looking to future-proof their financial operations.

In conclusion, the marriage of blockchain and accounting for small businesses represents a paradigm shift in financial management. The technology not only addresses existing challenges but also opens new possibilities for efficiency, security, and innovation in the realm of small business finance. As more businesses explore the potential of blockchain, the landscape of small business accounting is poised for a revolutionary transformation.